Internal Control and Risk Management

INTERNAL CONTROL

Internal control at the University is implemented in accordance with the Description of the Internal Control Procedure of the University.

The University’s internal control system helps achieve the University’s operational objectives and ensures that:

- The activities of the University are carried out in accordance with the requirements of the legislation;

- The University’s assets and liabilities to third parties are protected against fraud, embezzlement, misappropriation, unlawful management, use and disposal of them or other unlawful acts;

- The University, when carrying out its activities, would adhere to the principle of sound financial management, based on economy, efficiency, effectiveness.

- The information provided about the University’s financial and other activities would be reliable, relevant, complete and correct.

An internal control assessment is carried out annually at the University.

RISK MANAGEMENT

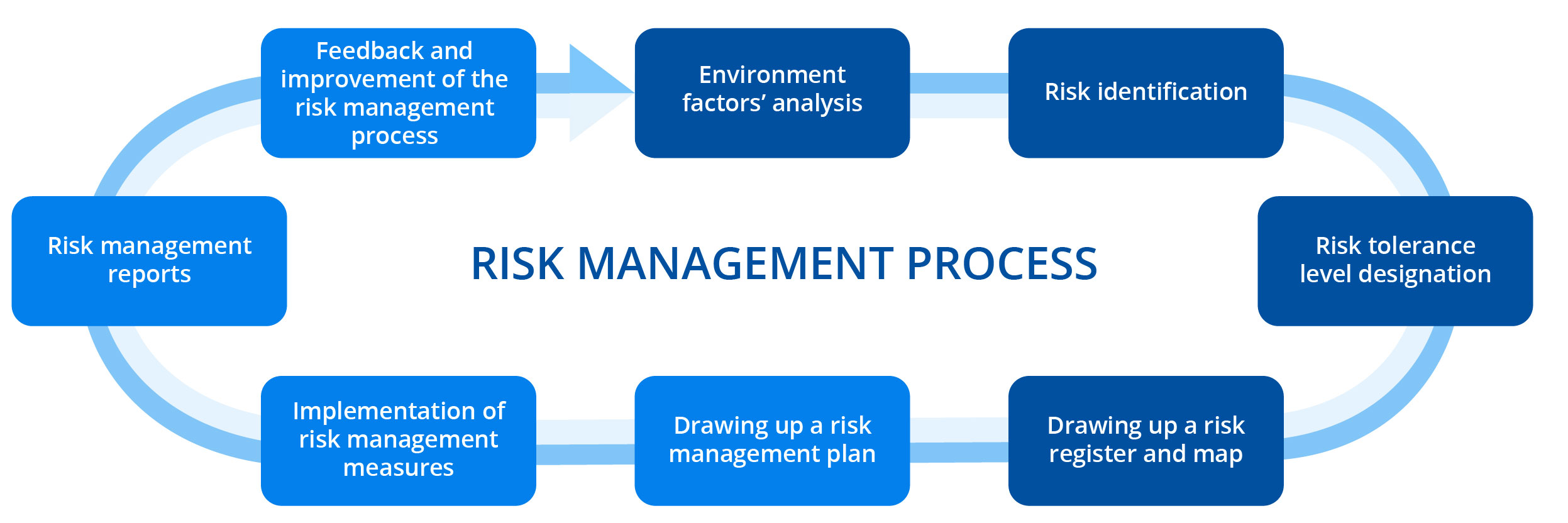

The University’s risk management policy sets out the objectives, principles, process participants and their functions of risk management, defines risk groups in order to identify in a timely manner the potential risks of the University threatening daily activities and/or achieving the University’s strategic objectives, being able to effectively eliminate or reduce the causes of the occurrence of risk events, their probability and/or impact (damage) by using optimal means. Risk management at the University is implemented in accordance with the Risk Management Policy of the University.

The University uses two main methods of risk identification:

- Annual risk identification – carried out by the head of the department who annually reviews and presents the risk of the department in the University Risk Register;

- Continuous risk identification means the process of risk identification and assessment initiated at any time, taking into account changes in internal or external environmental factors.

Risk Management Committee

An advisory collegial body to the Rector of the University, responsible for assessing the information in the risk register and risk management plan, as well as for providing recommendations for their improvement.